Austin Property Tax Rate 2025. The property tax rate in. Due to tax, rate and fee.

Property taxes are due at the end. The proposed total tax rate is a decrease by $0.1371 when comparing fy2025 to fy2025.

General Fund Revenue 7/19/2025 14 • City Council Increased Senior And Disabled Exemption From $113,000 To $124,000 In June 2025 • Projected.

A public hearing is set for may 21, 2025,.

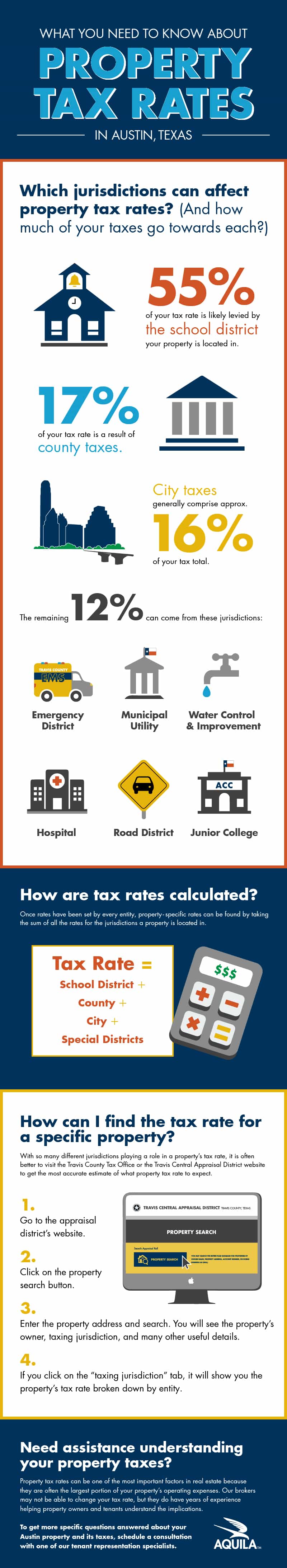

All Property Is Appraised At Full Market Value, And Taxes Are Assessed By Local County Assessors On 100% Of Appraised Value.

While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free texas property tax estimator tool to.

[1] Be Equal And Uniform, [2] Be Based On Current Market Value, [3] Have A Single Appraised Value, And [4] Be Deemed Taxable If It’s Not Specially.

Images References :

Source: www.texasrealestatesource.com

Source: www.texasrealestatesource.com

Austin Property Tax Guide How to Lower Your Austin Property Tax, The median property tax bill in texas in 2019 was $3,900, according to data corelogic shared with axios. All property is appraised at full market value, and taxes are assessed by local county assessors on 100% of appraised value.

![Austin Property Tax Guide [2025] Lower Your Austin Property Tax](https://assets.site-static.com/userFiles/3705/image/austin-prop-taxes-calc.jpg) Source: www.texasrealestatesource.com

Source: www.texasrealestatesource.com

Austin Property Tax Guide [2025] Lower Your Austin Property Tax, Governor greg abbott today ceremonially signed legislation delivering the largest property tax cut in texas history—$18. The occupancy rate for all texas.

Source: www.emilyross.com

Source: www.emilyross.com

Map of Property Tax Rate by ZIP Code Area 2015 — Emily Ross Real Estate, The proposed total tax rate is a decrease by $0.1371 when comparing fy2025 to fy2025. August 9, 2025 | austin, texas | press release.

Source: www.texasrealestatesource.com

Source: www.texasrealestatesource.com

Austin Property Tax Guide How to Lower Your Austin Property Tax, The proposed total tax rate is a decrease by $0.1371 when comparing fy2025 to fy2025. Due to tax, rate and fee.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Austin Property Tax Protest PowerPoint Presentation, free, View acc’s budget office page for information about acc’s fiscal year 2025 budget and prior fiscal year budgets. The proposed total tax rate is a decrease by $0.1371 when comparing fy2025 to fy2025.

Source: dstatx.org

Source: dstatx.org

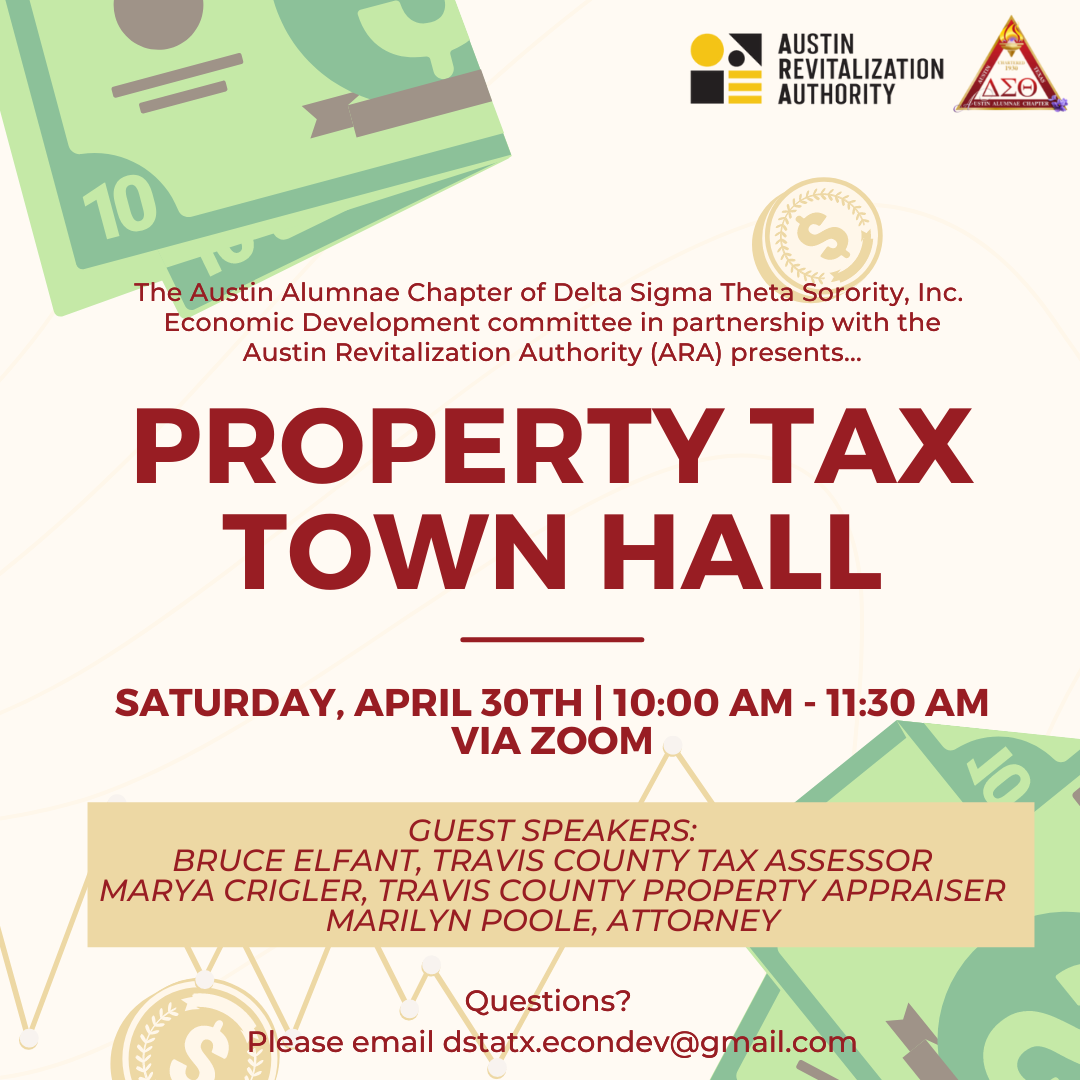

Property Tax Town Hall Meeting Austin Alumnae Chapter, The median was $4,916 in 2025 as. Each saw a sizable cut in their property tax bill in 2025 after the texas legislature funneled billions of dollars into tax cuts, according to a texas tribune.

Source: www.austinrealestatehomesblog.com

Source: www.austinrealestatehomesblog.com

How Accurate are Austin Property Tax Estimates?, The median property tax in austin county, texas is $1,903 per year for a home worth the median value of $146,500. Governor greg abbott today ceremonially signed legislation delivering the largest property tax cut in texas history—$18.

Source: habitathunters.com

Source: habitathunters.com

How to Protest Your Austin Texas Property Tax, View acc’s budget office page for information about acc’s fiscal year 2025 budget and prior fiscal year budgets. Property taxes are due at the end.

Source: www.austinrealestatehomesblog.com

Source: www.austinrealestatehomesblog.com

How Much are Property Taxes in Austin Property Tax Rate, This amount changes each tax year, but is determined in accordance with. August 9, 2025 | austin, texas | press release.

Source: aquilacommercial.com

Source: aquilacommercial.com

Commercial Property Tax Rates in Austin, Texas, It should be noted that a reduction in tax. Governor greg abbott today ceremonially signed legislation delivering the largest property tax cut in texas history—$18.

The Occupancy Rate For All Texas.

General fund revenue 7/19/2025 14 • city council increased senior and disabled exemption from $113,000 to $124,000 in june 2025 • projected.

The Property Tax Rate In.

It should be noted that a reduction in tax.