Kansas Income Tax Rate 2025. For tax years 2024 and all tax years thereafter, the individual income tax rates will be as follows: That's because the highest state income tax rate is 5.7% for 2024.

The flipside of these fairly low income taxes is a sales tax rate that’s a bit on the high side. Income tax rates in kansas are 3.10%, 5.25% and 5.70%.

All Social Security Benefits Would Be Exempt From Kansas Income Tax At The Beginning Of Tax Year 2024.

(ap) — kansas legislators are struggling to overcome political divisions that have prevented their state’s residents from seeing major income tax cuts.

Kansas Income Tax Rates Might Provide Relief To Some Taxpayers With Higher Incomes.

Kansas has a graduated corporate income tax, with rates ranging from 3.5.

Kansas Income Tax Rate 2025 Images References :

Source: livewell.com

Source: livewell.com

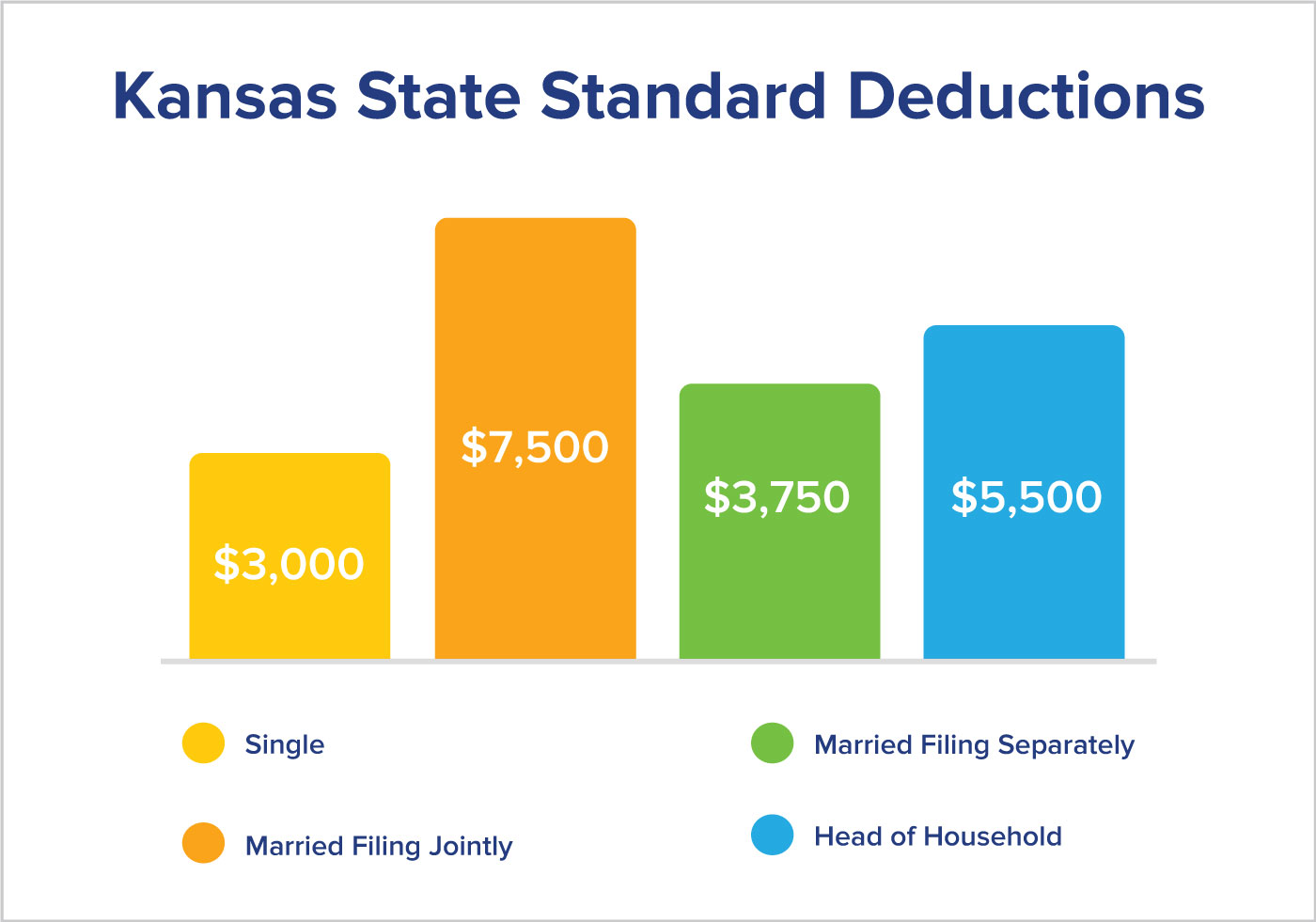

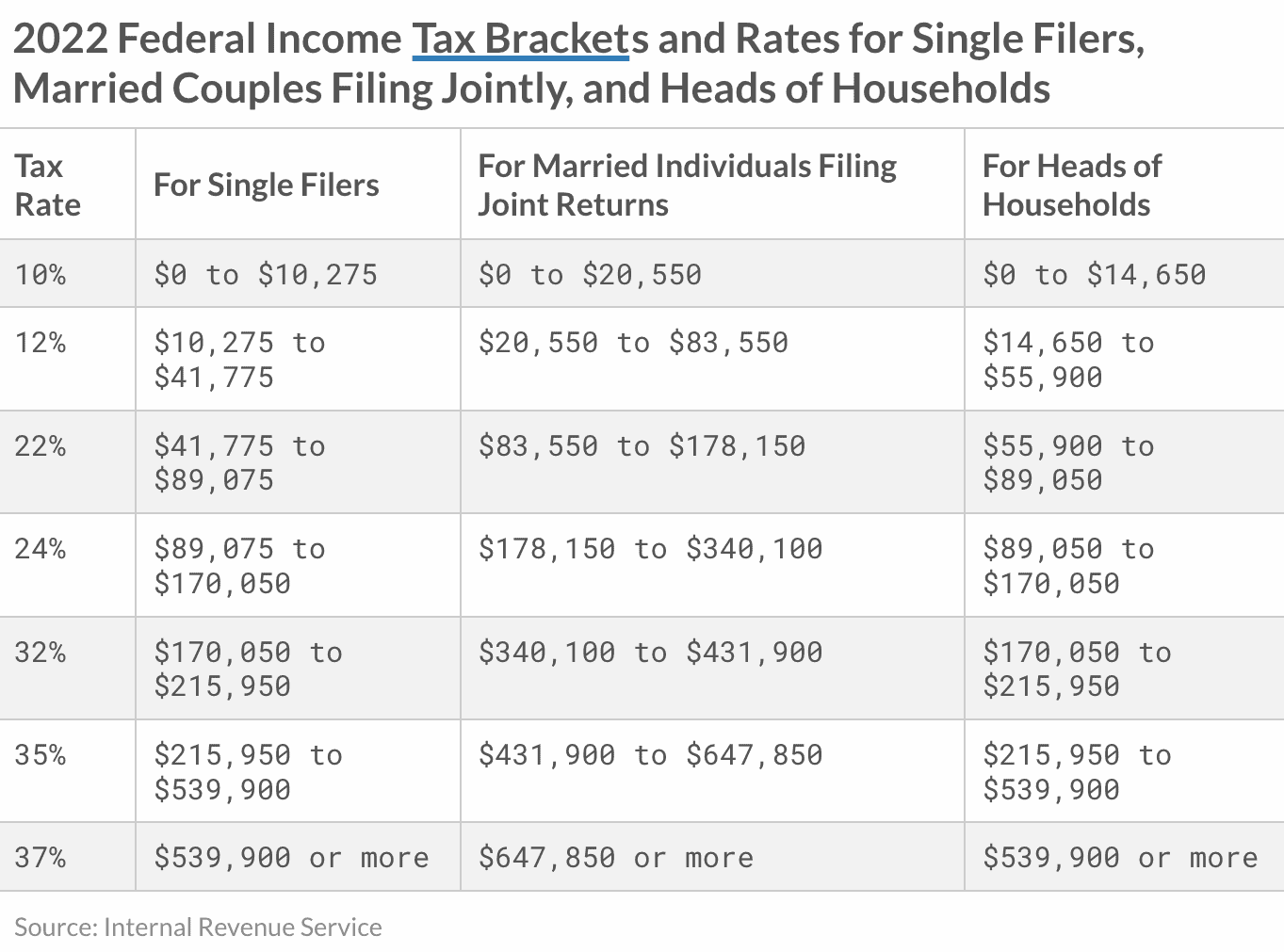

What Is Kansas Tax Rate LiveWell, The flipside of these fairly low income taxes is a sales tax rate that’s a bit on the high side. While, the maximum individual income tax rate of 37%.

Source: www.taxuni.com

Source: www.taxuni.com

Kansas Tax Calculator 2023 2024, Kansas income tax rates might provide relief to some taxpayers with higher incomes. For married individuals filing jointly, taxable income.

Source: www.taxuni.com

Source: www.taxuni.com

Kansas State Tax 2023 2024, The state will forgo an estimated $300 million by dropping the. Individual income tax tax rates, resident, married, joint.

Source: imagetou.com

Source: imagetou.com

Tax Rates 2024 2025 Image to u, While, the maximum individual income tax rate of 37%. Calculate your annual salary after tax using the online kansas tax calculator, updated with the 2024 income tax rates in kansas.

Source: www.youtube.com

Source: www.youtube.com

Earned Tax Credit (EITC) for Kansas State Taxes YouTube, That's because the highest state income tax rate is 5.7% for 2024. The minimum income tax rate is 10% in 2024, to be fulfilled by individuals with incomes of $11,600 or less.

Source: itep.org

Source: itep.org

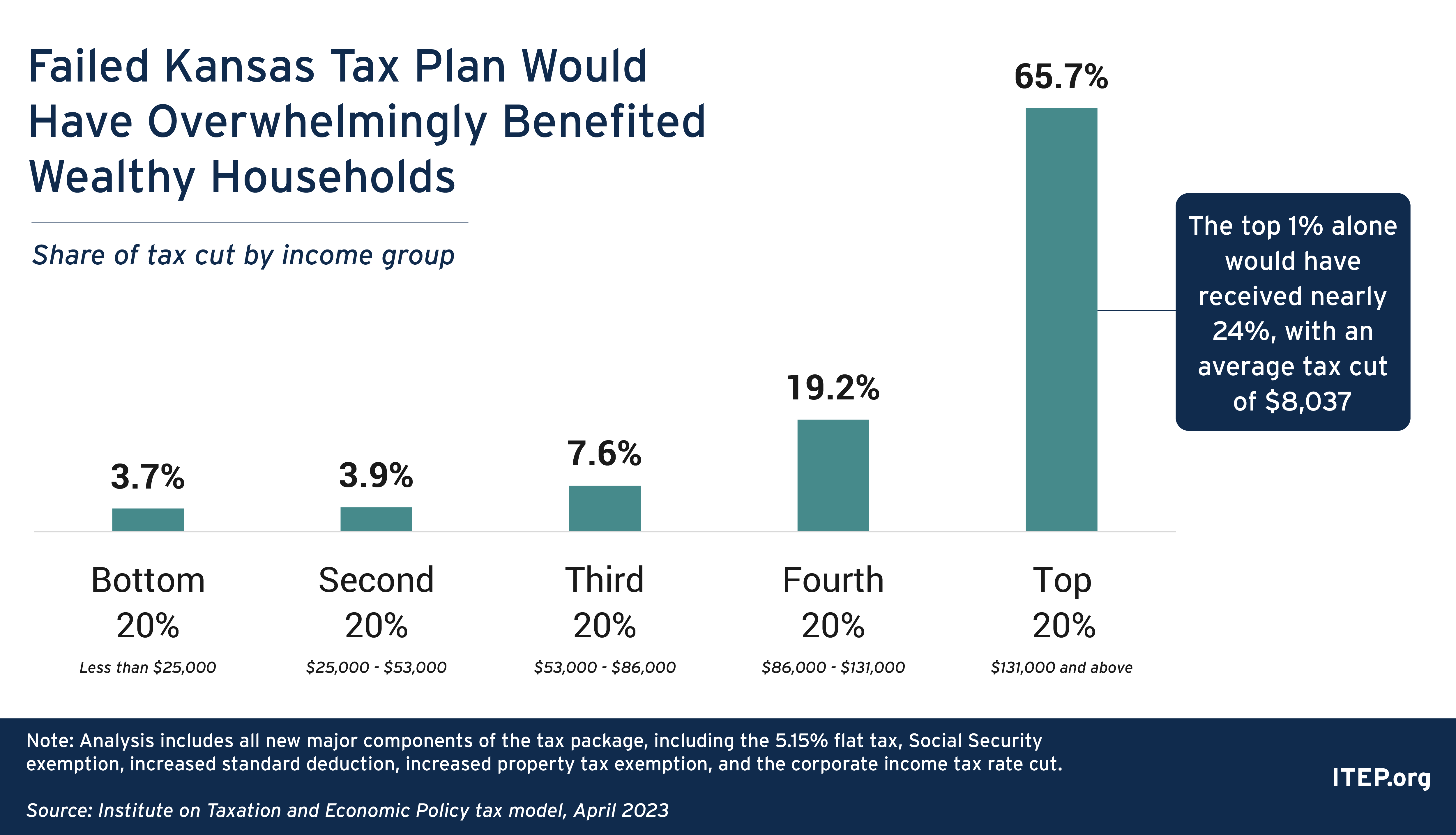

Kansas Avoids Flat Tax Proposal Narrow Victory a Cautionary Tale for, Tax year 2018 and all tax years thereafter. For married individuals filing jointly, taxable income.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Shifting Retirement Assets From TaxDeferred To TaxNow By 2026, The income tax rate is supposed to drop 0.1% a year until reaching 4.99% if state revenues hold up. The house bill would also accelerate the elimination of the.

Source: dulciqmarybeth.pages.dev

Source: dulciqmarybeth.pages.dev

Us Tax Brackets 2024 Married Jointly 2024 Juli Saidee, The bill would move kansas from three individual income tax rates to two, with the top rate dropping to 5.55% from the current 5.7%. Kansas has a graduated corporate income tax, with rates ranging from 3.5.

Source: slidetodoc.com

Source: slidetodoc.com

Kansas Tax Changes 2017 Presented by Hosted, For married individuals filing jointly, taxable income. That's because the highest state income tax rate is 5.7% for 2024.

Source: www.modwm.com

Source: www.modwm.com

Tax Rates Sunset in 2026 and Why That Matters Modern Wealth Management, The income tax rates and personal allowances in kansas are updated annually with new tax tables published for resident and non. Income tax rates in kansas are 3.10%, 5.25% and 5.70%.

Calculate Your Income Tax, Social Security And Pension Deductions In Seconds.

The flipside of these fairly low income taxes is a sales tax rate that’s a bit on the high side.

(Ap) — Kansas Legislators Are Struggling To Overcome Political Divisions That Have Prevented Their State’s Residents From Seeing Major Income Tax Cuts.

The bill approved by kansas lawmakers would move the state to two personal income tax rates instead of the current three, setting the top rate at 5.55% instead of the.

Category: 2025